A glance at owner move-in evictions in 2018

By BORNSTEIN LAW | JANUARY 31, 2018

Since the date of this writing, relocation payments have gone up and there may be additional changes. For informational purposes only - please contact an attorney.

Owner Move-in evictions, or “OMIs”, permit property owners to recover possession of a tenant-occupied unit for use as their primary place of residence – or a relative’s use where the landlord already lives in another unit in the building.

In cities with rent ordinances such as San Francisco, Berkeley, Oakland and others, landlords need a specific reason to evict, known as a “just cause”.

One of the most common “just causes” is when the property owner wants to vacate tenants from a unit and home himself or herself into the unit. to relocate tenants for their own use. This is known as an owner move-in eviction or “OMI eviction”, which are allowed only if certain conditions are met.

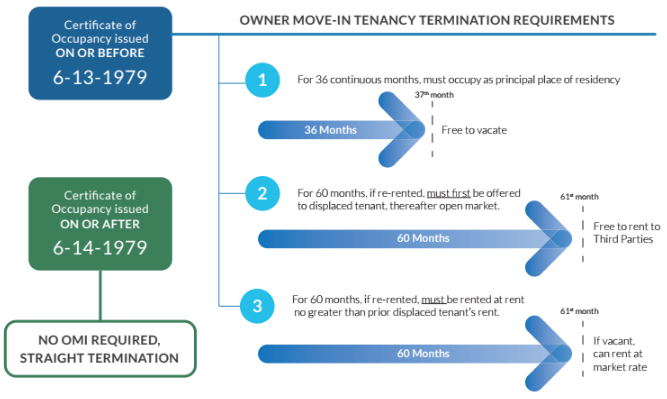

Generally, an owner may recover possession of a unit covered by a local rent ordinance for use as his or her principal residence for at least 36 continuous months.

We will concentrate on San Francisco for now and touch on the nuances of OMI evictions in other Bay Area locales in concluding remarks.

OMI eviction laws have always put owners on notice that transitioning tenants out of units must be done in good faith, without ulterior motive and with honest intent, and are only permissible in limited circumstances. yet tenant advocates have successfully lobbied for additional oversight to ensure the owner is maintaining the unit as their principal place of residence.

Aaron Peskin, a progressive Supervisor, makes his case for reform. In July of 2017, the SF Board of Supervisors voted to amend the Rent Ordinance to increase protections for tenants who receive an owner move-in or relative move-in eviction notice, and instituted stronger penalties for landlords who abuse OMIs.

Although the obligation of a landlord to have the good faith intent to occupy the residence for at least thirty-six continuous months remains as it had been prior to the new laws, the new law requires the landlord to attest to having that good faith under the penalty of perjury.

Reforms that modify Section 37.9 of the San Francisco Rent Ordinance

Effective 8/27/17

37.9(a)(8)(v): Clarifies what kind of evidence is relevant towards proving that a landlord did not perform an OMI eviction in good faith.

37.9(f): Extends the statute of limitations for a wrongful eviction lawsuit following an OMI eviction from one to five years.

37.9B(a): Limits the initial rent the landlord may charge a new tenant for a five-year period following service of an OMI notice to no more than that which the displaced tenant would have paid had the displaced tenant remained in occupancy.

37.10A(h) and (i): Strengthens existing law regarding misdemeanor prosecutions by the District Attorney.

37.11A(a): Allows a tenant who was charged excess rent during the five-year period following an OMI notice to sue the landlord for treble damages and/or injunctive relief.

37.11A(b): Permits non-profit San Francisco tenant rights organizations to sue for wrongful eviction and collection of excess rent following an OMI eviction. The statute of limitations for such actions is three years, and monetary awards for rent overpayments may be doubled rather than trebled.

Effective 1/1/18

Prior to 1/1/18, landlords are not required to report to the Rent Board regarding the use of a rental unit following an OMI eviction and the Rent Board is not required to take any action after an OMI notice is filed with the Board, except to record a notice of constraints with the County Recorder pursuant to Section 37.9B(e). The August 27, 2017 OMI Ordinance Amendments create the following new requirements that go into effect ONLY for OMI notices served on or after 1/1/18:

37.9(a)(8)(v): Requires the landlord to attach a blank change of address form to an OMI eviction notice that the tenant can use to advise the Rent Board of any change of address. The required form will be available on the Rent Board’s website by 1/1/18.

37.9(a)(8)(v): Requires the landlord to include in an OMI eviction notice a declaration executed by the landlord under penalty of perjury stating that the landlord intends to recover possession of the unit in good faith for use as the principal residence of the landlord or relative for a period of at least 36 continuous months.

37.9(a)(8)(vii): Requires the landlord to file a “Statement of Occupancy” form with the Rent Board within 90 days after the date of service of an OMI notice, and an updated Statement of Occupancy every 90 days thereafter until the landlord recovers possession, and then once a year for five years after recovery of possession of the unit. The required form will be available on the Rent Board’s website by 1/1/18.

37.9(a)(8)(vii): Requires the landlord or relative who claims to be occupying the unit as that person’s principal residence to attach at least two forms of supporting documentation to the Statement of Occupancy to show that the unit is being occupied as that person’s principal residence.

37.9(a)(8)(vii): Requires the Rent Board to send a copy of each periodic and annual Statement of Occupancy to the displaced tenant, or a notice that the landlord did not file the required Statement of Occupancy.

37.9(a)(8)(vii): Requires the Rent Board to assess administrative penalties on any landlord who fails to file a required Statement of Occupancy and supporting documentation – $250 for first failure, $500 for second failure and $1,000 for every subsequent failure.

37.9B(e): Requires the Rent Board to send a notice to the affected unit that states the maximum rent for the unit within thirty days after the effective date of an OMI notice, and to send an updated notice to the unit annually for five years thereafter.

37.6(k): Requires the Rent Board to transmit a random sampling of 10% of all Statements of Occupancy to the District Attorney on a monthly basis. Also requires the Rent Board to send the District Attorney a list of all units for which the required Statement of Occupancy was not filed.

37.9B(b)(2): Extends from three to five years the time period after an OMI notice during which a landlord who intends to re-rent the unit must first offer the unit to the displaced tenant. The offer must be filed with the Rent Board within fifteen days. The tenant has thirty days from receipt of the offer to notify the landlord of acceptance or rejection of the offer and, if accepted, forty-five days to reoccupy the unit.

For those of you that are visual, we’ve put together a graphic of OMI tenancy termination requirements, to open the discussion on whether this may be a viable route.

Information required for preparation of owner move-in notice of termination

Single Family Home or Multi-Unit Property?

(Single family home with legal/illegal in-law is classified as a multi-unit property.)

Tenant in Possession for 12 or More Months or Less than 12?

Written Documentation

- Lease Agreement

- Tenant Estoppel Certificate/Tenant Questionnaire

- Recorded grant deed

Tenant Information

- Names of occupants (whether or not named on lease)

- Length of each occupant’s tenancy (Determines whether relocation expenses are required)

- Are there any minors or persons who attends or works at a school in San Francisco currently living in the unit?

- Current monthly rent for the unit.

Owner Information

- Names of persons moving into property, including minor children;

- List of all property owned in whole or in part by each owner;

- Current address(es) of owners/persons moving in;

- Written consent to evict by all owners not moving into the property;

- Is any property owned in whole or in part by any record owner vacant or soon to become vacant? Has a prior owner move-in eviction ever taken place at the premises?

Some takeaways from the recent OMI changes

The most notable change we observed is the level of oversight and redundancies by the Rent Board.

The rental property owner must file a “Statement of Occupancy” form with that body within 90 days after the date of service of an OMI notice, with updated documentation every 90 days thereafter until the unit is repossessed by the landlord, but it doesn’t end there.

Once a year for five years after the recovery of possession of the unit, the landlord-turned occupant must check in with the Rent Board to once again show that the underlying OMI Eviction was made in good faith.

The modifications to San Francisco’s Rent Ordinance is the gift that keeps giving, with an ominous extension of the statute of limitations for a wrongful eviction lawsuit following an OMI eviction, from one year to five years. OMIs, then, are not transactional in nature and landlords contemplating this vehicle should expect to be strapped in for the long haul.

Do you qualify?

Before contemplating an OMI, owners should answer the fundamental question of whether they are eligible. To qualify, the landlord must have at least a 25% ownership interest in the property if it was purchased after 2/21/91, or 10% if purchased prior to that date

Two individuals registered as domestic partners can combine their ownership interests to meet the required percentage.

Owners are prohibited from recovering possession if there is a comparable vacant unit owned by the landlord available. As noted previously, an owner must make the unit their principle place of residence, as in singular – the owner can only have only one “principal place of residence.”

The landlord or relative moving in must be a “natural person” and cannot be a corporation, partnership, or other business entity. There are several other prohibitions best reviewed with an attorney.

Statutory Relocation Payments

For Notices served between March 1, 2017 and February 28, 2018, the relocation amount due per tenant is $6,281 with a maximum relocation amount per unit of $18,843.

However, elder persons, disabled tenants, or households with minor children are afforded additional favor. These vulnerable groups may be entitled to additional $4,1888 each, pursuant to RO Sec. 37.9C. When tenants fall into this category, it is all the more important to consult with the landlord lawyers at Bornstein Law.

Beyond San Francisco

While other cities have adopted some similar provisions of San Francisco’s OMI rules, local ordinances that govern owner move-in evictions vary across the Bay Area.

Passed by Oakland’s City Council on January 16, the Uniform Relocation Ordinance creates a schedule of relocation payments that will increase every year based on Consumer Price Index fluctuations. Other municipalities have adopted their own rules that regulates an owner’s desire to terminate a tenancy in order to move themselves or a close relative into a unit. With the housing shortage upon us and a litany of proposals by tenant advocates, these laws are in flux. You can rely on Bornstein Law to help you stay ahead of any changes or amendments that are sure to come.

While our goal here was to provide an overview of some considerations surrounding owner move-in evictions, many complex issues remain. Contesting a tenant’s protected status, defending against claims that the eviction was made in bad faith, a myriad of rent board petitions and numerous other complex issues are best approached with the guidance of the experienced landlord attorneys at Bornstein Law.