Vacancy tax looms for owners of San Francisco housing stock not made available to people seeking a place to live

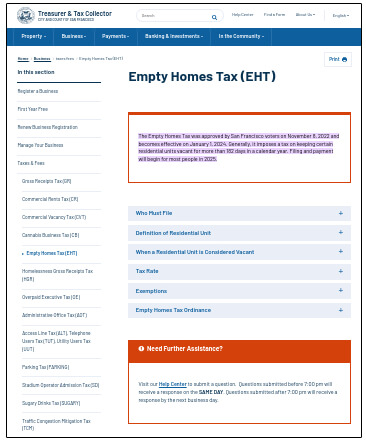

On January 1, 2024, San Francisco’s empty homes tax will punish owners who let their properties go idle, with requirements to file and pay the Office of the Treasurer and Tax Collector starting April 30, 2025.

![]()

Once upon a time, when you owned something, whether it was a car or anything else, you could choose to use it or not use it as long as no law was broken and it didn’t infringe on someone else’s rights. But now, a growing number of locales are dictating to owners that their property must be used for the greater public good, or there will be a price to pay.

San Francisco’s vacancy tax law will slap owners of buildings of three units with a punitive tax if a residential unit has been vacant for more than six months in a given year. As if the initial penalty is not compelling enough for owners to be in the city’s good graces, the taxes are ratcheted up the longer the property is deemed to be vacant. The larger the square footage, the higher the tax.

The attorneys at Bornstein Law manage landlord-tenant relationships on a daily basis, but we are not crusaders in challenging laws in court. Other brilliant litigators argue in court that laws should be struck down and a lawsuit is progressing that has challenged the legality of Measure M.

Landlord groups have submitted that the right to keep properties vacant is protected under the Fifth Amendment and that, under the Ellis Act, owners cannot be penalized for retiring their rental units.

We do know, however, that these types of lawsuits take time. After several postponements, the next court date is December 20 in Department 501 of the San Francisco Superior Court, yet the City Attorney's office has filed a Demurrer to the complaint, arguing that the action is premature because the law hasn't taken effect yet. It will likely be put off until the new year, so we'll have to anticipate and deal with the misguided law.

The tax collector was all too willing to provide some background and answers to questions as they seek to shake down owners not in compliance.

Visit their web page dedicated to this topic →

What Bornstein Law can do and our takeaways

What constitutes a “vacant property” is in the eye of the beholder. San Francisco regulators can claim that a particular property is vacant, but Bornstein Law can provide a counternarrative that units are not being productive, but that there are plans underway to realize the potential of the property.

A multiplicity of factors contribute to San Francisco’s reputation as a high-crime hellscape that might make the city unattractive to the retention of some businesses and residents.

While we cannot attribute all of the social woes and the city’s exodus of residents to policymakers, we can say that the dearth of housing certainly has not been helped by a complicated regulatory regime and the barriers landlords have to overcome when fixing up vacant properties.

It can take several hundreds of days to get the permits necessary to bring rental properties up to a habitable condition, much less marketable to renters in the market.

While the political rhetoric normally falls squarely on the side of tenants, there are few people in the corner of landlords. Bornstein Law fills that void.