A mixed bag of news for housing providers in Oakland

New relocation payment amounts are required for no-fault evictions. An updated RAP notice to serve on tenants. Owner rights are severely restricted if units are not registered or business taxes go unpaid. A measure that would allow landlords to pass through waste removal services has failed. And more.

“The oak tree and the cypress grow not in each other’s shadow.”

~ Kahlil Gibran, Lebanese-American writer, poet, and philosopher

We are proud to be East Bay residents. Over the course of three decades practicing law, we have been thrilled to see Oakland spread its wings and become a force of its own. It no longer plays second fiddle to its neighbor of San Francisco. Yet with these growing pains, there were calls for increased tenant protections. Fast forward to today and these protections have spiraled out of control.

At one time, we thought that San Francisco and Berkeley were home to the most pernicious regulations for landlords to follow. Over time, Oakland has supplanted its sister cities and arguably has become the Bay Area’s greatest bastion of tenant protections anywhere. Let’s review them in light of recent developments.

New relocation payment amounts effective July 1, 2025

Under Oakland's Universal Relocation Ordinance, tenants are entitled to a financial cushion if they are displaced through no fault of their own. If owners are contemplating an owner or relative move-in eviction (OMI/RMI), permanently withdrawing rental units from the market by way of the Ellis Act, or a condominium conversion, get out your pocketbook.

The relocation payment amounts will vary based on the size of the unit and are adjusted for inflation annually on July 1st. The most recent numbers are off the press.

-

$8,042.34 per studio/one-bedroom unit

-

$9,898.26 per two-bedroom unit

-

$12,218.17 per three-or-more-bedroom unit

However, we're not done just yet. If the household is composed of lower-income, elderly, or disabled tenants, and/or minor children, landlords must cough up an additional $2,500 per unit.

Updated RAP notices

The RAP Notice is a crucial requirement under Oakland's Rent Adjustment Program (O.M.C. 8.22). Most residential rental units built before 1983 are covered by the ordinance, excluding single-family homes and condos. This mandatory disclosure is to be provided in three languages at the commencement of the lease and when certain other events occur, like when the landlord endeavors to raise the rent.

Big brother is watching

The rights of owners are stripped if they fail to register the units, update/confirm existing tenancy information, or claim that a unit is exempt from the city's rent registry. This information is due annually every March and there will be hell to pay if units are not brought into the light of day.

San Francisco's rent registry, called the "Rent Board Housing Inventory," requires that units be registered to get a license to raise rents. Yet Oakland goes a step further. Housing providers in Oakland who fail to register will not only forfeit their right to raise rent; uncompliant landlords will also be disallowed from filing petitions or answering petitions filed on behalf of tenants. Moreover, the failure to register is an affirmative defense in most eviction actions, even if the owner has a "just cause" reason to evict.

Delinquent on business taxes? Owners can be prevented from using "no-fault" evictions and be unable to justify rent increases

Property owners in Oakland who rent out properties are required to file and pay an annual business tax. This involves obtaining a business tax certificate and paying taxes based on gross rental income. If the city is not paid, landlords cannot use their properties as they see fit because no-fault evictions are prohibited. Additionally, they will be unable to raise rents or take advantage of "banked" rent increases that provide for rent increases beyond the allowable annual rent increase.

Oakland will not take your word for it that you are in good graces; if the rent increase notice includes banking, owners will be required to provide a copy of a current Business Tax Certificate. This is a good segway into our next topic.

Banked rent increases will be curtailed in 2026

Housing providers in Oakland can "bank" unused or partially used rent increases and apply them in future years, but there are limits to how much can be banked and how it can be used. At the time of this writing, landlords can bank up to ten years' worth of rent increases, but that will soon change. Starting January 1, 2026, this banking capability is set to be reduced to five years.

Moreover, the transfer of banking to new property owners will be prohibited except for transfers through an inheritance between spouses or between parents and siblings, children, or stepchildren, and only if that transferee owns the property for at least one year.

At Bornstein Law, we have already seen a debilitating impact on the sale of multifamily properties because potential buyers want to maximize cash flow and rely on banked rent increases to justify the purchase. Bad policy, folks.

Perhaps most concerning of all: Landlords cannot demand rent until the rent owed reaches a certain threshold

As we said in an earlier article, tenants must pile up enough rent debt before they are served a 3-Day Notice to Pay Rent or Quit. It used to be that if a tenant owes rent, we serve a notice and if the rent goes unpaid after three days (excluding weekends and judicial holidays), our clients can immediately proceed with an eviction action. But now we have to ascertain how much rent is owed.

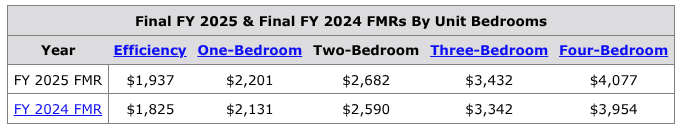

If the rent owed is not enough, we can't demand it. Tenants must owe at least 1 month of the Fair Market Rent for the unit size, as determined by HUD. In the above example, let's say the tenant has a one-bedroom apartment and owes $1,800 in rent arrears. Owners will have to wait until they owe the full $2,201 - the Fair Market Value - before formally demanding the rent. This regime allows tenants to pay in drips and drabs. Renters take to the Internet and are increasingly savvy. With no incentive to pay rent on time, they are prone to pay late and wait until the last minute to pay the full amount once it reaches this threshold.

We have strategies to interrupt this vicious cycle of rent delays - contact our office.

Oakland City Council rejects garbage pass-throughs

Garbage service costs have soared by 48% over the last six years, while allowable rent increases have been capped at a measly 13% during the same time period. See the disparity? A measure would have empowered housing providers to petition for rent increases to recoup these rising garbage service costs, but the City Council rejected it.

A special thanks to our friends at the East Bay Rental Housing Association (EBRHA) for galvanizing property owners to share their stories of financial strain and advocate for the pass-throughs. About the only thing that stinks more than the garbage is the corruption between waste companies and the city, escalating costs, and a council that consistently ignores the hardship of rental property owners.