Biden looks to roll back gains on 1031 Exchanges

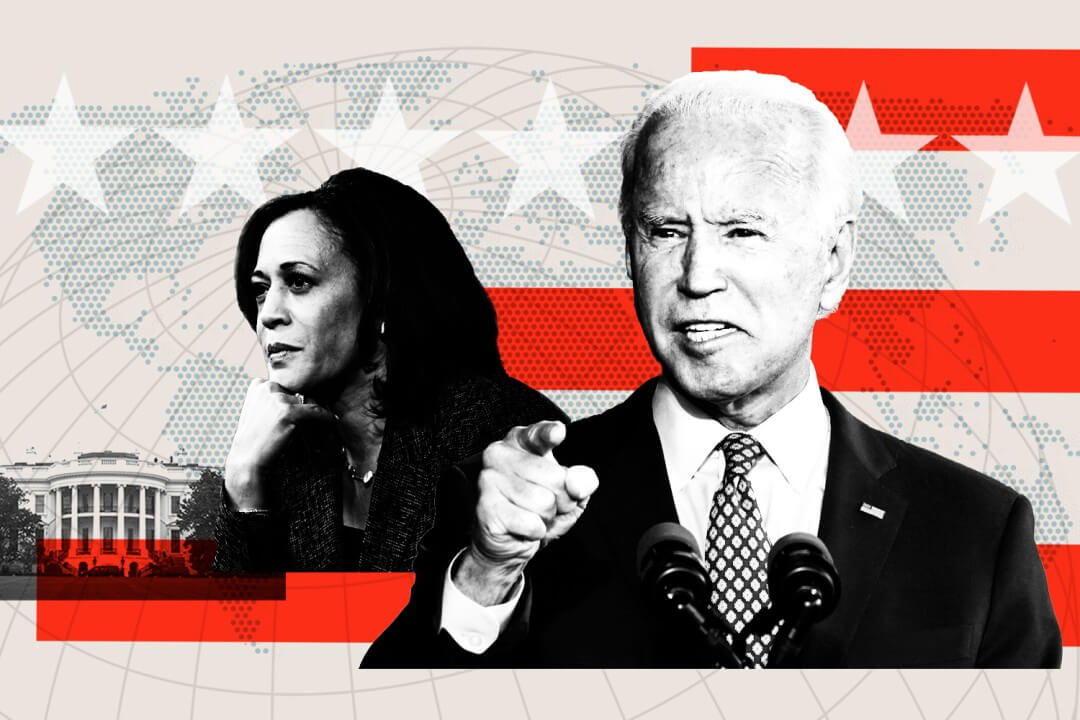

On the campaign trail, then-candidate Biden pledged that he would rein in the tax-deferral vehicle of 1031 exchange, and the President may make good on this promise. Bornstein Law joins the rest of our community in strongly opposing a measure to weaken investor benefits by removing 1031 exchanges on real estate profits worth more than $500,000.

Some background

Most in our community are familiar with 1031 Exchanges, but for the benefit of those who are not, owners who sell properties and realize a gain generally must pay a tax on that gain at the time of sale. IRC Section 1031 is the exception to this rule, allowing investment property owners to postpone paying tax on the gain if those gains are reinvested in similar property as part of a qualifying like-kind exchange.

A proven wealth-building strategy is under assault

There will always be hiccups. The market will always go up and down, but the American Dream of homeownership has always paid off over the test of time as values go up. When a homeowner takes on the risk, hassle, upkeep of their investment and waits it out, there is a big shiny thing at the end that says once they are ready to sell, they can do so tax-free and elevate their lot in life.

There are some cynical types who will say real estate has been the playground for the rich and well connected, but it’s for everyone

Ironically, while the goal of tampering with 1031 exchanges is meant to target the wealthy big operators, it will do irreparable harm to the “little guys” (or gals) who have relied on a tremendous wealth-creation tool to move into bigger, better more expensive properties and asset classes.

Any proposal to water down the benefits of a 1031 exchange is not a tale of a modern-day Robin Hood taking money out of the pockets of rich investors and giving it to those less fortunate; it stifles the upward mobility of young, up-and-coming investors and middle-class families looking to move up and build intergenerational wealth. We also know that there are many professions that rely on real estate transactions that will directly be impacted when investors decide to hold onto their properties instead of selling.

Eliminating the incentive of a 1031 exchange robs everyone and only stands to aggravate California’s affordable housing dearth and hinder the economic bounce back from COVID. In a bulleted fashion, let’s expose the fallacy of the proposal.

Number of casualties

It’s been estimated that 1031 exchanges are the engine of growth behind 568,000 jobs in 2021 and that these exchange transactions will pump a total of $55.3 billion into the economy. Workers involved in these transactions run the gamut, including real estate brokers, title insurers, contractors, material suppliers, surveyors, architects, and other professions too numerous to name. This economic activity can only occur when there are incentives to buy and sell properties.

Another blow to new housing

When investors trade up to bigger properties without getting saddled with a huge tax burden in the process, new housing is created. 1031 exchanges keep the market fluid and without them, many property owners will sit on the properties for an extended time. The government will get their taxes at some point, but IRC Section 1031 allows investors to kick the can down the road as long as possible. This means that as investors avoid Uncle Sam by not letting go of their property, sorely needed inventory will be reduced, and inevitably, this hoarding will result in higher prices.

Harder for new investors to buy real estate

Since sellers have less incentive to unload their properties, it will be harder for new investors to buy real estate, many of them younger people who deserve their fair shot at getting into the multifamily housing arena, but if 1031 exchanges are eliminated, these properties will be held onto by older people who have accumulated wealth through real estate without giving the opportunity to another generation of investors to follow in their footsteps. Without tax deferrals, a gaping wealth gap remains.

We understand there is a distrust for goliath investors and lawmakers want to penalize them in order to fund programs for the "little guys" but tampering with 1031 exchanges, ironically, will irreparably harm the little guy.

Big investors will stay in the little pool

In the way of a newsflash, big investors want to make big profits, and tax savings are a big motivator to sell. By taxing gains over $500,000, what we see happening is that corporate buyers will migrate away from large deals and gobble up single-family homes, duplexes, triplexes, and so forth, and it will make it even more competitive for first-time homeowners and small investors to have a fighting chance to purchase a property.

Lawmakers have expressed disfavor over large investors and want to level the playing field, but meddling with 1031 exchanges will only mean that these savvy, behemoth investors will look for another route to save money. As for those bigger deals, the rest of the less-endowed investors will not be able to touch them.

Parting remarks and more resources

While the government is trying to penalize big investors, at the end of the day, it will hurt new homeowners and mom and pop landlords, as well as an army of workers who will suffer from a reduction of real estate transactions if a smart policy that has been around since 1927 is altered.

Our friends at Asset Preservation, Inc. have admonished our community to preserve 1031 exchanges by contacting lawmakers and they have made it easy to do so with a templated message you can send at www.1031taxreform.com/take-action.