A refresher on California security deposit law, which may soon change

![]()

We are real sticklers for accounting but whenever we peel back the books, about 80% of housing providers do not get it right when it comes to security deposits. Let’s review California security deposit law, with an asterisk that it may change soon.

As of the date of this writing, the allowable amount of deposits for unfurnished residential properties is equivalent to two months’ rent. For furnished residential properties, the maximum is three months’ rent.

If the unit is pet friendly, according to California Civil Code Section 1950.5, landlords can charge tenants with furry friends a pet deposit to protect against scratches on floors, carpet stains, or chewed furniture - but we don’t want to get into a rabbit hole of complexity. No pun intended.

Bornstein Law has been closely observing the agenda of a so-called renters' caucus that is composed of the only five members in the state capitol who pay rent to a landlord and do not own a home.

One of the members, Assemblyman Matt Haney of San Francisco, bemoans the fact that many people shopping for housing cannot afford to pay $10,000 or more to secure a suitable rental unit taking into account exorbitant security deposits.

Haney was the architect of AB 12, a bill that would limit security deposits to one month’s rent for both furnished and unfurnished units.

The legislation has sailed through both the Senate and Assembly and is on Governor Newsom’s desk for his signature by October 14.

California security deposit law prescribes the permissible uses of security deposits by landlords.

›Covering unpaid rent.

› Repairing damage to the rental beyond normal wear and tear. Cleaning the property to restore it to the condition it was in at the beginning of the tenancy (minus normal wear and tear).

› Other purposes agreed upon in writing.

"Normal wear and tear” is an ambiguous term. What does it mean?

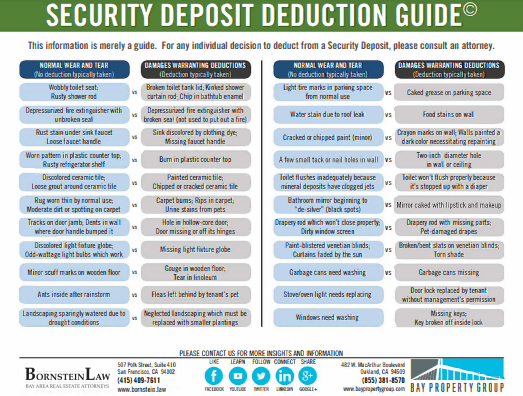

In California, landlords can't deduct from a security deposit for "normal wear and tear." But what exactly constitutes "normal wear and tear" can sometimes be a subject of dispute between landlords and tenants. It's essential to differentiate between damage caused by negligence, misuse, or abuse by the tenant and the natural decline that occurs due to everyday use or aging.

Having managed landlord-tenant relationships for the better part of three decades, Bornstein Law has developed a good sense of what this term means and has put together a one-pager that provides guidance for landlords and their agents when determining what and what not should be deducted.

Download our security deposit deduction guide →

Being transparent, from the beginning to the end of the tenancy.

We can’t stress enough the importance of walking through the tenant early on to do an inspection of the property and another tour when the tenant leaves.

By law, landlords are required to offer an inspection of the rental unit before the tenant moves out, its purpose being to identify potential deductions from the security deposit. Afterward, the tenant must be furnished with an itemized list of potential deductions, giving them the opportunity to fix them.

The biggie is the return of the security deposit.

Within 21 days after the tenant moves out, the landlord must return the security deposit and if there are any deductions from the security deposit, the tenant must be provided an itemized statement showing the nature and amount of each deduction. This should include receipts for the charges that the landlord has incurred or a good faith estimate for repairs that will have to be carried out.

Do not get a false sense of bravado.

As a bit of trivia, disputes over security deposits are the #1 reason landlords are dragged into small claims courts, but the consequences are not trivial.

If there is evidence of “bad faith retention,” when the landlord retains the security deposit without a reasonable basis, the tenant may be entitled to up to twice the amount of the security deposits in damages, but it doesn’t end there.

There are opportunistic tenants’ attorneys who are now suing landlords for the emotional distress caused by slighted tenants who have been improperly denied the return of their security deposit. That’s right - it used to be that housing providers were on the hook only for the amount of the money the tenant exchanged for a security deposit, but now that figure can be multiplied.

Other issues abound.

In some locales like San Francisco and Oakland, the security deposit must be deposited in an interest-bearing account and one that is separate from personal funds to avoid commingling. Sadly, we’ve seen a lot of fed-up owners who decide to get out of the landlording business and sell their property. Owners need to recognize that if the rental property is sold, the landlord must transfer the security deposits to the new owner or return them to the tenant.

Finally, it is not uncommon for tenants to leave without informing the landlord. When a “runaway tenant” flies the coop and does not provide a forwarding address, landlords must still make a good faith effort to return the security deposit and/or provide an itemized statement of deductions.

Many risks can be avoided with the proper selection of a good tenant, and we urge landlords and property managers to do their due diligence on the front end to find excellent tenants so that we do not have to deal with California security deposit law.

As the allies of rental property owners and the real estate professionals who serve them, Bornstein Law is dedicated to handling problematic landlord-tenant relationships and helping landlords power through their real estate challenges. For informed advice, get in touch.