Ensure that your lease agreements are not a Dinosaur

![]()

Rental agreements should be a living, breathing creature reflective of new laws and challenges encountered by the rental housing community.

In an ongoing series, we will give you a glimpse into our mindset in terms of what verbiage should be included in leases and the mutual expectations of landlords and tenants.

Have every adult tenant sign the lease

When each adult (18+) signs the lease, they are jointly and severally liable. In plain English, this means that each person is responsible for the entire rent and also responsible for damages, not just their share.

If an adult tenant is not named on the lease, it will be more difficult to evict them if the need arises. We not only want every adult to sign the lease; we also want them to acknowledge the terms and make them duty-bound to follow them.

The alternative? The landlord may only be able to hold the signers accountable for unpaid rent or damages. Moreover, courts may view unsigned adults as tenants-at-will, giving these individuals more rights than intended.

If a tenant says something like, “My husband is on a business trip and he will sign the lease when he comes back,” say NO. All adult tenants must sign before the keys are handed over.

List all occupants in the property

There may be some occupants who are not tenants but nonetheless occupy the premises. A straightforward example is minors who cannot enter into a lease agreement. We want to name them and their date of birth.

What we’re really trying to avoid is a game of musical chairs where there is a constant shuffling of occupants, a back-and-forth with occupants coming and going. Landlords need to know who is occupying their property, and this is a good segway into our next point.

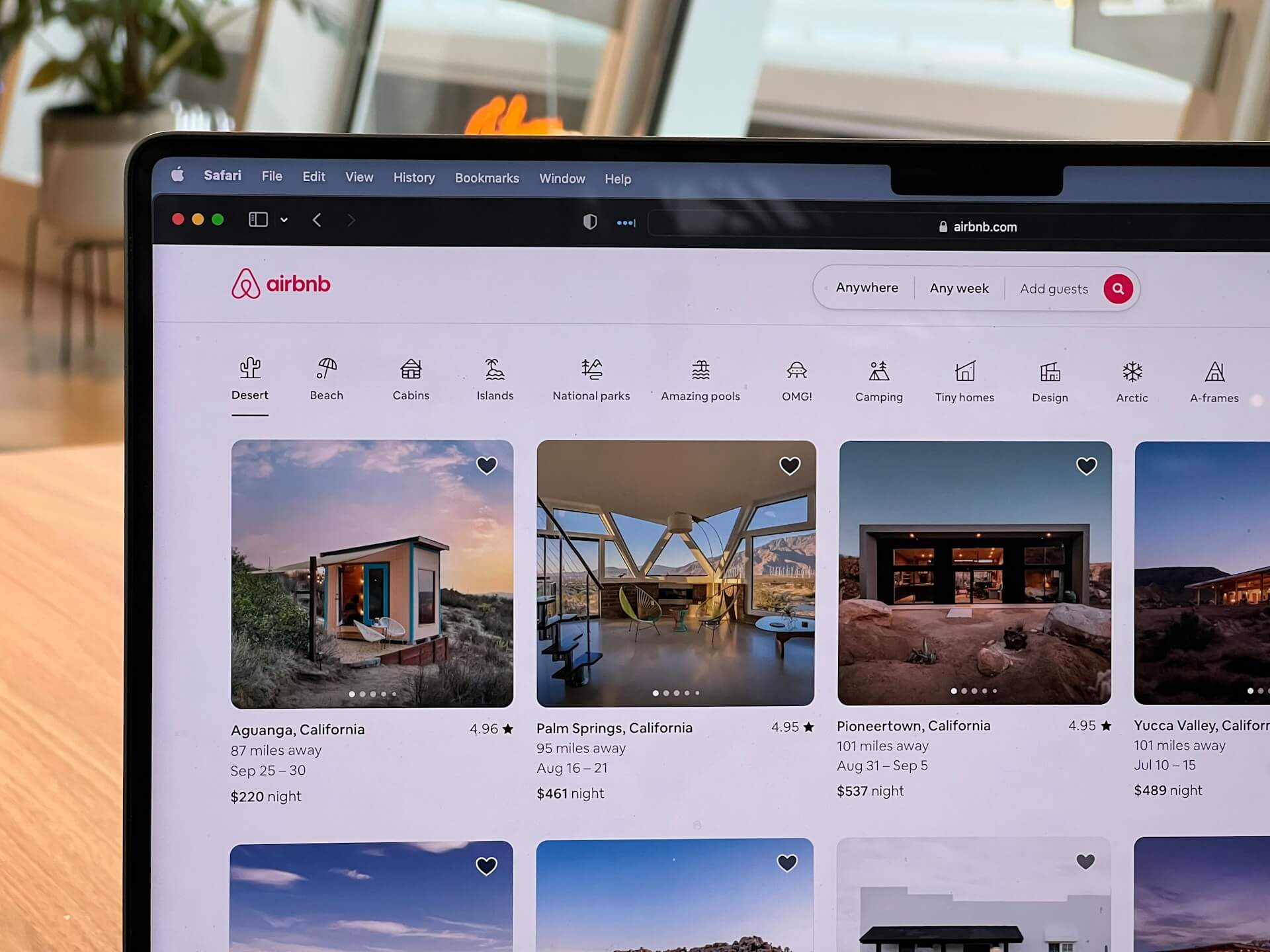

Prohibition of advertising short-term rentals

Any lease agreement worth its salt will ban unauthorized subletting or assignment, and this is normally a “just cause” reason for eviction. The question is how to enforce a ban on Airbnb and other modern-day iterations of the temporary flop.

Let’s give a hypothetical.

An unfamiliar face waltzes into an owner’s rental property with luggage. These unwanted guests claim that they have just rented the place for the weekend to visit their daughter, who attends school in the Bay Area, and they want to enjoy all the sights, sounds, and delights this region has to offer. They are all too happy to rent out a place, and unbeknownst to them, the tenant is not authorized to do so.

The landlord issues the tenant a 3-Day Notice to Cure or Quit to remove the unauthorized guests, but guess what? They are already gone. The parents are no longer paying for their short stay - they flew back home to New Jersey.

This leaves the owner powerless to evict the tenant because, well, the unpermitted occupants are no longer on the premises. The guests are unlikely to show up in court to testify that they paid money to their host.

But how did these random people find the place to begin with? Because it was advertised on an online platform. Therefore, there could be a theory for eviction that the tenant has actively sought out guests. Identify the ad and serve a 3-Day Notice to cease the advertising on whatever website.

If the ad is still online, landlords have perfected their right to evict.

Requiring that the tenant carry renters insurance

We have always been big fans of tenants who take out a renter’s insurance policy on their own initiative. Generally speaking, tenants who opt for this type of policy are responsible individuals who take pride in the condition of their place and are good custodians of the premises.

A landlord’s insurance policy only covers the building, not the tenant’s personal property. It is smart for housing providers to embed in the lease a requirement that tenants carry renters insurance to be protected from claims of damage from unforeseen circumstances. If a pipe bursts, for example, the tenant is likely to seek compensation for their destroyed electronics and that $10,000 Persian rug they own.

Moreover, if a tenant causes damage (like a kitchen fire or water overflow), their renters insurance may cover the costs, reducing disputes or claims against the landlord.

Finally, a renters insurance policy will typically cover temporary housing and related costs if the unit becomes uninhabitable due to a covered peril such as fire, water damage, vandalism, or certain types of theft, etc. When the unit is damaged and the tenant is uprooted, they may ask their landlord to be put up in a five-star hotel with a massage in the afternoon. But with renters insurance, the expense is deflected.

The tenant cannot be evicted for the failure to carry renters insurance because case law suggests that this breach is not material enough to warrant eviction, but we want to include this requirement so that if calamity strikes, landlords can point to that clause and say that damages would be covered if the tenant did as they were told.

As a word of caution, housing providers cannot rely on a tenant’s renters insurance to cover relocation if the damage stems from habitability violations like mold, plumbing issues, lack of heat, and so on. If the landlord is responsible for defects, they will be held responsible for relocation costs.

How to pay the rent

Some landlords state in the lease that they will just “show up” to collect the rent, unaware of the laws that give tenants several options to fulfill their obligation to pay rent.

- Zelle, Venmo, PayPal, and other electronic payment portals are fashionable, and we certainly want to offer the convenience for tenants to pay rent online. Yet that cannot be the only method of payment.

- The tenant can pay cash, but the tenant must be given a receipt. If a check has bounced, the landlord can mandate that future payments be made in cash with proper written notice explaining the situation and attaching a copy of the dishonored payment.

- Tenant can mail payment to a designated address or P.O. Box provided by the landlord.

- For drop-off locations, landlords may designate a physical location for rent drop-off, be it an office or lockbox. In this option, housing providers must provide the address and the days and hours when it is accessible, of course, disclosed in writing.

- If the tenant elects to make a direct deposit to the landlord’s bank account, they will need to be notified of the nearest bank branch and the hours of operation.

That’s it for now. We’ll review additional lease terms in future articles.

Most importantly, we want housing providers to review the nuances in the area where their property is located. We love the California Apartment Association, but many owners do not understand that in certain locales, there must be unique verbiage embedded in the lease that spells out local rent control laws, tenant protections, and disclosures that go beyond California state law.

In San Francisco, for example, the tenant must be informed that the unit is subject to the Rent Ordinance, which limits evictions and regulates the amount of rent that can be charged.

When we first began our legal careers three decades ago, there were only three rent/eviction control ordinances. Fast forward today, and there are multiple regulatory regimes throughout the Bay Area. Of course, you can rely on the firm built for rental property owners to make sense of it all.