Fraudsters help welcome unsavory rental applicants into their new homes by producing bogus information

A CPN is the trade word for a Credit Privacy Number, a 9-digit identification number used as an alternative to a Social Security Number (SSN) when applying for a loan, lease, or other purchases that require a credit check.

It’s been touted as a way for celebrities and other discreet people wary of sharing personal information due to the risks of identity theft and the desire to remain private, but it’s also used by individuals to conceal a poor credit history, evictions, broken leases, and other blemishes that would raise red flags in the rental application process.

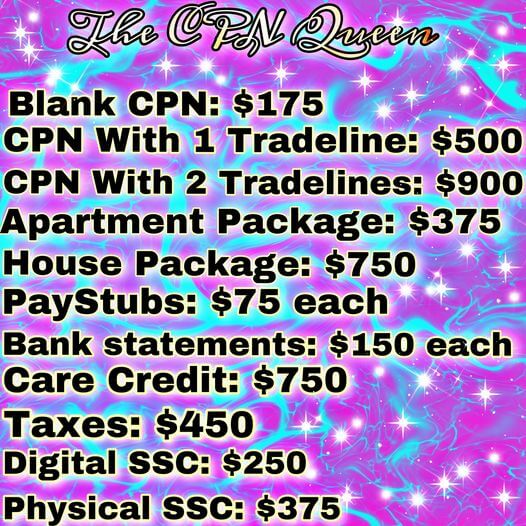

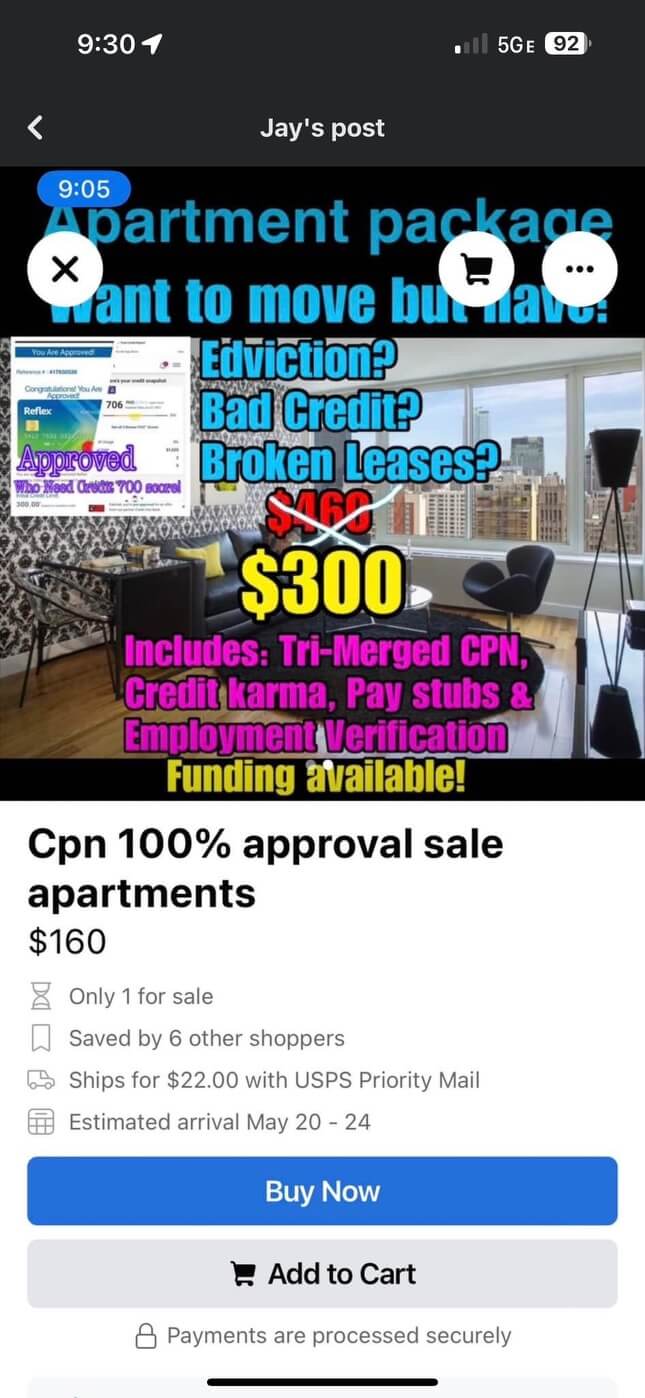

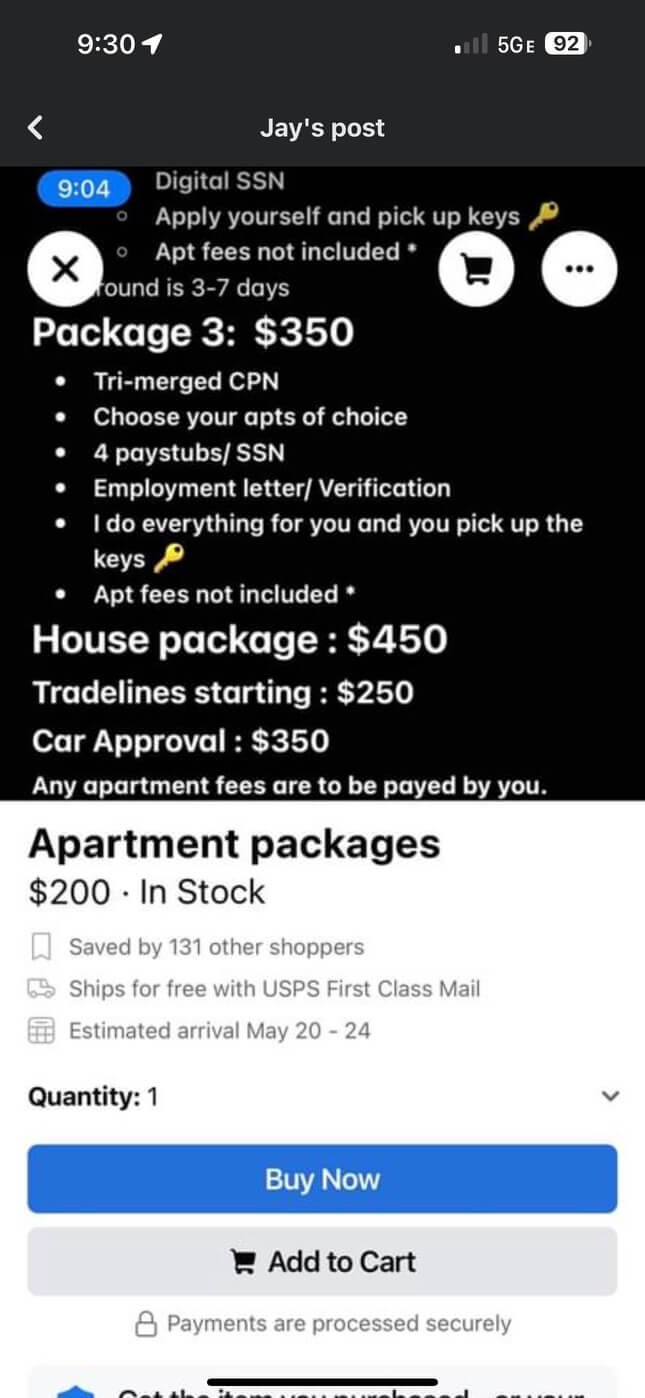

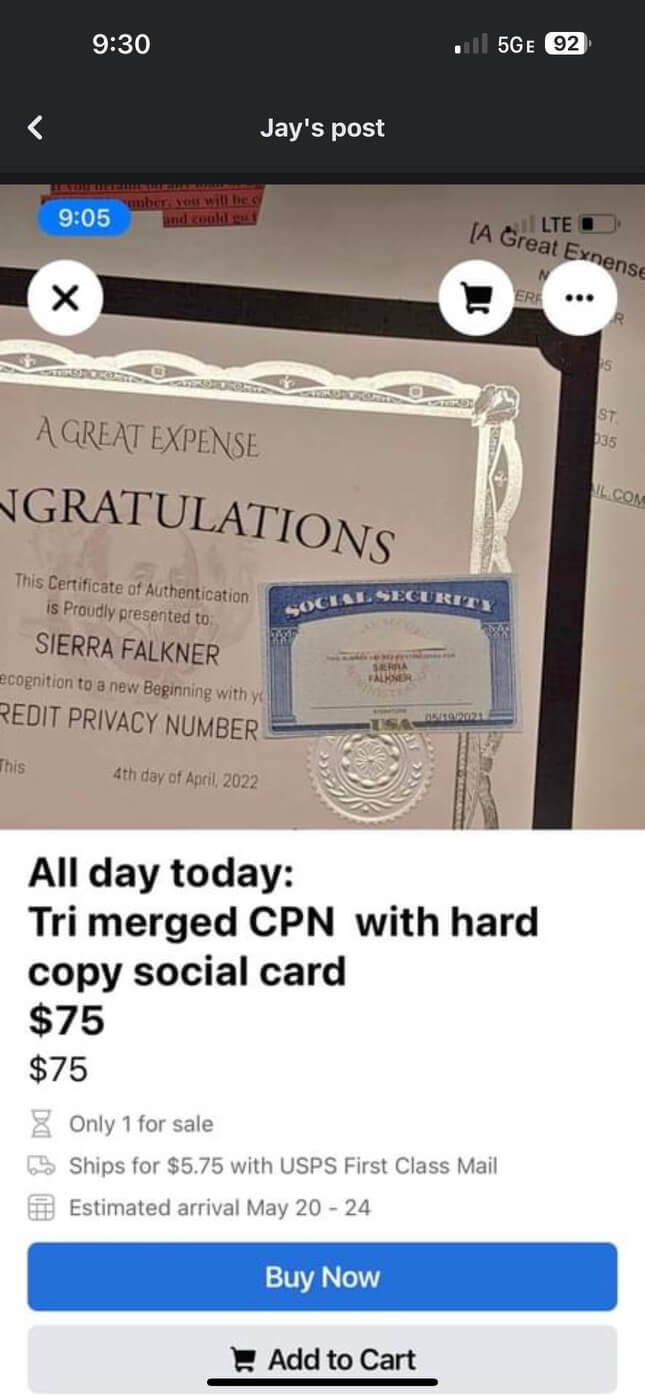

Although this novel form of identification is not inherently illegal, it is ripe for abuse. Many of these CPNs are linked to actual SSNs that have been stolen and peddled on the dark web. Shadowy online operators with no clear business entity (preferring to go by first names or handles like the “CPN Queen”) promise apartment shoppers a clean slate with a profile that paints them as model tenants. Unsuspecting housing providers can be fed a lot of misinformation.

These fraudsters have plastered the Internet and social media with ads that tell rental applicants it is as easy as picking up the keys once a checkered past has been wiped out,. High rental risks are armed with manufactured pay stubs, social security numbers, and even bank accounts.

Here are but a few advertisements we came across.

Some of our takeaways

There are many tenant screening tools with bells and whistles, but we want you to know that technology is no panacea.

California has a culture of amnesty, and what we mean by that is that there is a strong preference to keep people housed, and this overarching goal of keeping people housed is oftentimes more important for policymakers than the need for landlords to make informed decisions about who they should rent to.

For individuals with a history of criminal acts or not paying creditors, it is reasoned that they deserve a “second chance.”

This is why in some instances, criminal background checks and credit checks are banned. From our hard-won experience, the biggest indicator of nonpayment and other dysfunction in rental relationships is prior behavior that occurs over and over again - it has a high recidivism rate. Yet increasingly, housing providers are blinded by measures that conceal rental risks.

The technological marvels of tenant screening are no substitute for a gut feel and old-fashioned personal sleuthing that includes references from past landlords.

It’s one thing to say that technology cannot be used as a crutch and that some aspects of a rental applicant’s history will be masked, unable for the rest of the world to see some mistakes. Maybe we can live with the fact that people make bad decisions and can redeem themselves.

It’s quite another thing to use technology to deceive landlords and property managers by manufacturing false information, and we see this happening at an alarming pace. We can’t help but draw a parallel with fraudulent claims that tenants need a comfort animal for conditions such as anxiety or depression.

Fortunately, California lawmakers caught on and enacted a law that says renters asserting the need for a comfort animal, also known as an “emotional support animal” cannot just take to the Internet and download a certificate; they must have a medical provider who they have had a prior relationship with certify the need for a furry friend.

After fielding so many questions about these types of animals, our lives were made much easier with the new law, but it didn’t stop many tenants from forging documents by copying and pasting a logo into a crude document.

Housing providers need to use common sense, trust their instincts, and be aware that some tenants, aided by technology, will attempt to pull the wool over the eyes of landlords. As a real estate attorney for the better part of three decades and the broker of a property management company, Daniel Bornstein is happy to have a dialogue with you on how to avoid common pitfalls and evaluate rental risks.