NEW YEAR RESOLUTION

I will familiarize myself with new laws related to government-subsidized housing.

There is a love-hate relationship with Section 8 housing. Many landlords like the steady stream of predictable income from Uncle Sam, but there are less endearing aspects of the program. All we can say is that like life, participation in the program can be a wonderful experience for you, or it can be difficult. Assuming you have weighed the pros and cons and have decided to opt in, we’ll make a few remarks.

A new law entitled “Credit history of persons receiving government rent subsidies” (SB 267) bans housing providers from prying into the rental applicant’s credit history, so long as the applicant provides legal, verifiable evidence of their ability to pay their portion of the rent. This can come in the form of government benefit payments, bank statements, etc.

We can live with SB 267. It’s not all that onerous because candidly, we would not expect that a rental applicant with a housing voucher in hand would have pristine credit. We are concerned that many landlords are unaware of the law and will get in trouble by running credit checks and summarily denying a tenancy based on credit history without allowing the applicant to demonstrate their ability to pay despite of blemished credit.

We don’t want to get too technical, but there are other obligations housing providers may have under the newfangled CARES Act. Whenever there is a landlord-tenant dispute, it is a stressful situation for landlords, but when a problematic tenant has a housing voucher in hand, it adds new layers of complexity, making it imperative to seek proper legal counsel.

A word to housing providers in Oakland

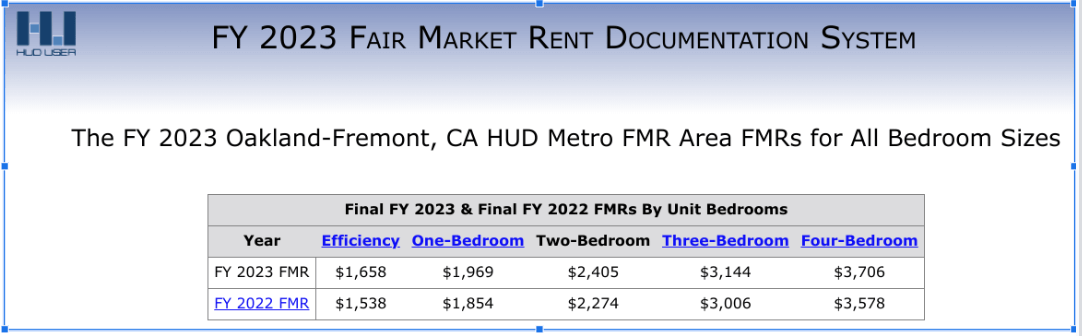

Oakland lawmakers have done something extraordinary by enacting a law prohibiting tenants from being evicted until the amount owed reaches certain thresholds. If the rent owed is below the fair market rate, as determined by HUD, the landlord cannot serve a 3-day notice demanding rent until the amount of rent owed is equal to or greater than one month’s fair market rent, as illustrated here:

While this new law gives heartburn to all housing providers, it is especially troubling when a tenant is a recipient of a housing voucher. Let’s say the rent for a 2-bedroom apartment is $2,000 and the Oakland Housing Authority is paying $1,800. The tenant’s share of rent owed is $200. Before the law, we could serve a 3-day Notice to Pay Rent or Quit but fast forward to today and do the math. The tenant could conceivably live rent-free for a year because the amount they owe has not reached the threshold to evict.

We hope the absurd law is challenged in court, but we’ll have to deal with it.

Having an open-door policy with applicants who have a housing voucher in hand

In 2023, there has been a rash of discrimination lawsuits by enterprising attorneys representing clients who were denied tenancies because of their source of income. The landlord will get a call that goes something like this:

“Hi, I’m interested in the apartment advertised on Craigslist. Do you take Section 8? … to which the landlord or their agent replies, “No, I’m sorry. We do not accept Section 8 applicants.”

The prospective tenant then calls an opportunistic attorney who reminds the landlord of fair housing laws and threatens to sue unless the case is settled out of court for a large sum of money. In this webinar, Daniel admonishes housing providers not to summarily reject rental applicants based on source of income and instead, welcome all applicants to apply.