Supervisor David Haubert hosted a town hall on Alameda County’s eviction moratorium. Our takeaways.

Except for limited circumstances, landlords are unable to evict or even demand the payment of rent. The Board of Supervisors has failed to revisit the county’s draconian eviction moratorium and this inaction has left rental property owners in a suspended state of ambiguity. Is there any end in sight?

Any discussion about Alameda County's path forward must begin with acknowledging the public service of Supervisor Richard Valle. We were saddened to hear of his passing. The rock of his family, a veteran who served honorably in the Vietnam war, and a crusader for many causes endeared to him, he poured his heart and soul into the community. He will be missed.

Let's dive in.

Don't get us wrong, rental housing providers in Alameda County owe Supervisor Haubert gratitude for bringing this topic to the forefront.

The town hall meeting had a lot of sound bites that rental housing providers wanted to hear. All of the notes were hit in a perfect symphony.

We are in a much different position today than we were in the COVID era. There were predictions of an eviction tsunami that never came ashore, gainfully employed tenants have gamed the system by pulling up in their apartment with a new car even though the rent has not been paid.

Supervisor Haubert related accounts of rental units being trashed with impunity and responsible, paying tenants who were forced to move elsewhere because of neighboring residents who considered the eviction moratorium to be a license to engage in nuisance behavior. Landlords who lived on the premises who have to invite others to rent out their own shared living quarters because other tenants were not paying rent. The horror stories can continue.

Mr. Haubert gets it. But now, some action has to be taken.

Where we go from here is a February 28th meeting where the full Board will revisit the moratoria after having the topic kicked down the road time and time again. Most recently, Moms 4 Housing protesters repeatedly disrupted a board meeting, causing it to be adjourned. The 28th is coincidental because it also marks the day when Governor Newsom is expected to declare a public state of emergency over with. These dates coinciding probably weren't planned, but it has some symbolic meaning that shouldn't escape the Supervisors.

While we appreciate this topic being brought front and center, we want to correct some statements that were made in the meeting.

The delusion of collecting COVID-related rent debt is perpetuated

In the town hall, Supervisor Haubert pointed out that under the current regulatory regime, rent debt is deferred, not waived - the tenant will still owe money to the landlord.

Does anyone believe that this mountain of rent debt will be recouped? Even if a judgment is obtained by the landlord, the prospect of collecting the money owed is abysmal. If a tenant living from paycheck to paycheck has accrued $50K in rent debt, what do you think the probability is the landlord will be compensated?

Every now and then, we have the opportunity to inform a client months or years after a judgment is obtained that there is good news: the debtor wants to satisfy the debt owed. Not necessarily because paying the rent arrears is the right thing to do, but because it is a blemish on their credit. They apply for a car loan, or perhaps they are seeking to buy a home and are unable to survive the underwriting process because there is a flaming beacon of a judgment on their record.

These surprises are few and far between, but they do occur when the tenant has a good job and has upward mobility in life. For other tenants, credit is not a concern. If he or she has other judgments, it's not a big deal to have another one.

Ideally, landlords or property managers do their due diligence to attract the right tenants but we do know that there is an ever-enlarging effort to conceal rental risks by concealing certain information on the prospective tenant's background.

Small claims vs. Superior or "regular" court

There was some confusion on the call about how to "chase" rent debt, be it in a small claims court or Superior Court.

In fact, the California legislature was prophetic by anticipating a huge number of lawsuits from landlords seeking rent debt that piled up from the pandemic and so lawsuits can be filed in small claims court for amounts over $10,000. In a small claims action, however, the plaintiff (landlord) cannot be represented by an attorney except on appeal.

Moreover, a small claims court can be in some respects a "kangaroo" court with less due process than a regular court. The landlord may lose despite having what is assumed to be a slam-dunk case of the tenant not paying rent.

The landlord can certainly bring suit in Superior Court, but we have to do a cost/benefit analysis.

One, what is at stake? Is the rent sizable enough to justify the added legal expenses of hiring an attorney? Two, what is the prospect of recovering the rent debt?

Is the tenant in arrears living paycheck to paycheck with little hope of recouping the rent owed, or is the defendant an affluent renter with an upward trajectory in life who would be motivated to settle in order to avoid a judgment? Bornstein Law would be happy to discuss this calculus with you.

Making landlords whole was a theme in the town hall

Rental assistance programs have dried up in a post-pandemic world. Many landlords have been left by the wayside, either because the tenant was uncooperative in the application for a pot of money made available by the government, or the tenant earned too much income to qualify for assistance.

Supervisor Haubert, along with state lawmakers, has proposed making these slighted landlords whole, but there has been no action taken so far. We regret to say that this may be a permanently lost income.

According to Krista Gulbransen, Executive Director of the Berkely Rental Housing Coalition, elected officials were naive in believing that rental assistance programs would take care of the problem, but the funding fell well short of the need. Lawmakers were then "reluctant to admit they were duped into advancing the agenda of social housing activists who want to eradicate the privatization of housing," she says.

Free legal help for small property owners?

Supervisor Haubert suggested that the cloth should be cut both ways. If tenants are facing evictions and are entitled to an attorney at no cost, Haubert said that mom-and-pop owners should also be able to have free legal resources at their disposal.

This is the first we have heard of this, but we would applaud such an initiative to level the playing field. Attorneys are not cheap and if tenants' attorneys can rachet up the legal bills of landlords, there should be some relief for cash-strapped small landlords who cannot earn rental income, much less pay a law firm like us thousands of dollars.

Lena Tam, please rise to the occasion

Although newly elected to her County Supervisor seat, Lena Tam is a seasoned leader well familiarized with housing issues. We thank her for spending many years in the trenches listening to the concerns of landlords and tenants and addressing their concerns.

During the town hall meeting, there was a suggestion that Lena Tam will be hearing about Alameda County housing issues for the first time on February 28. Assuredly, she is very well versed on this subject and we find it hard to believe that Supervisor Tam has to be educated on housing matters.

Although real-estate-backed Tam has been considered as being a pro-landlord voice on the board, she has yet to take an official stance on the eviction moratorium.

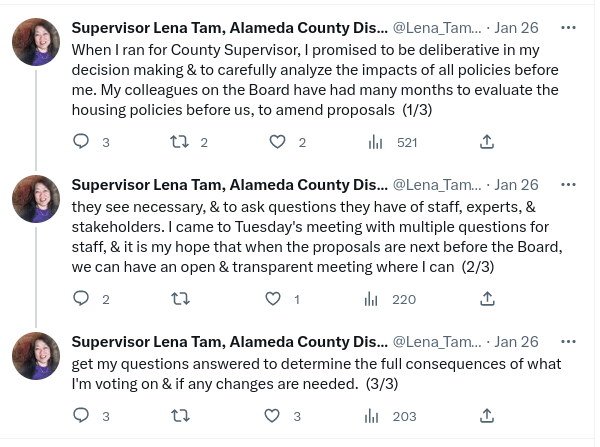

Based on recent tweets, however, we can at least say that the Supervisor has an open mind and will take a balanced approach. She certainly isn't hellbent on advancing the agenda of militant tenants' advocates.

Parting thoughts

Supervisor Haubert has recognized that the county is embroiled in a lawsuit challenging Alameda County's eviction moratorium that can cost taxpayers millions of dollars. Better for lawmakers to come up with a solution than to drag this through the courts.

Let's take a balanced approach, as Supervisor Haubert has proposed. Get landlords cash flowing again while giving a cushion to renters who have a genuine COVID-related hardship because they lost a job and have been unable to be re-employed. While at it, give some mortgage relief to owners who have had a shortfall in rental income.

The status quo is not acceptable, it is inevitable that the eviction moratorium ends, but lawmakers can make it as painless as possible by taking action now.