Evictions are reportedly at a 10-year high in San Francisco. Is the sky falling? We think not.

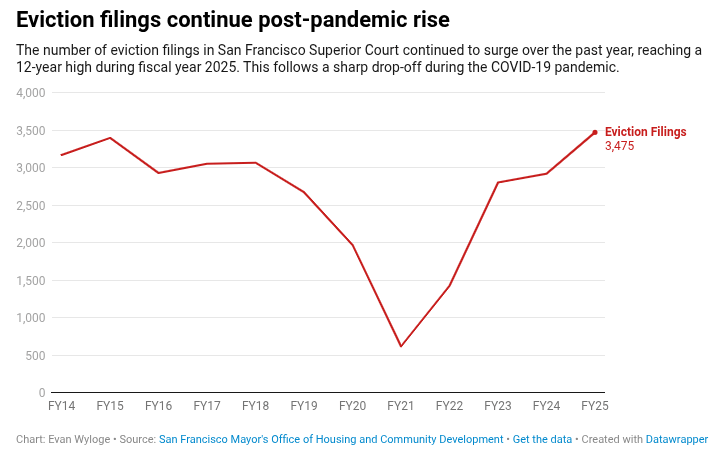

We were intrigued to come across a recent San Francisco Examiner article that reported a surge in evictions over the past year, hitting a 12-year high during fiscal year 2025. This spike follows a sharp drop-off during the global pandemic. Some background is in order.

Remember the apocalyptic warnings that once the COVID-era eviction moratoriums expired, there would be a “tsunami” of evictions? We do.

When things got somewhat back to normal and the slumbering courts were awakened, there was of course a precipitous spike in evictions as housing providers removed their surly shackles and became able to transition out problematic tenants. With pent-up demand to get cash flowing again, we would expect nothing less than a surge of unlawful detainer lawsuits.

Although landlords regained their ability to evict for nonpayment after these draconian moratoriums were phased out, it was not without casualties. Many mom-and-pop housing providers called it quits and left the rental business, if not having their life savings depleted or being forced to sleep in their cars.

There have been an abundance of very sad stories told to politicians who felt the pain of struggling housing providers and flirted with the idea of “making landlords whole,” but the spigots of funds were empty.

The rental housing industry was the only sector of the economy that was asked to provide a free service because housing was considered essential. So are groceries, but no one could fill up their shopping carts with milk and eggs and walk out the door without paying for these essential goods.

Landlords bereft of rental income during the long dark winter of COVID were greeted with calls to forgive rents and organized efforts for tenants to participate in rent strikes.

Politicians were quick to point out that COVID-related debt was deferred, not forgiven; tenants would have to pay down this debt later on. Did anyone believe at the time that this rent debt would be recouped? Tragically, this has largely permanent loss of income. In many cases, there are renters with an upward trajectory in life who want to preserve and improve their credit scores and will pay up to satisfy a judgment. Sadly, those tenants living hand to mouth with already tarnished credit do not give one iota about paying back rent arrears.

To add insult to injury, there was a huge chunk of tenants who had the ability to pay but refused to pay just because they were shielded by moratoriums. Landlords could observe their tenants going to work every day and in some cases, coming back home in a shiny new Tesla.

Eventually, during the post-pandemic era, we saw fewer flamboyant graffiti with calls to cancel the rent and a sea of signs stating that housing is a human right. When doomsday did not come to pass, this movement fizzled out. Yet the city and other observers have continued to track the rate of eviction filings. Yet the city and other observers have continued to track the rate of eviction filings. Let's take a look at the number of eviction filings in San Francisco Superior Court, as put on display by the San Francisco Mayor's Office of Housing and Community Development.

This publicly available data does not include the causes behind the evictions, leaving some to scratch their heads wondering why tenants are being escorted out. There is anecdotal evidence that the lion’s share of these evictions start because of nonpayment of rent. Based on the activities in our office, we can confirm this.

When asked for our take on a law that doubles the time tenants are allowed to respond to an eviction action, we told the Sacramento Bee that while there are an abundance of reasons to evict, such as keeping their unit in a state of disrepair or antagonizing neighboring tenants, nonpayment of rent is the easiest to prove.

Artificially high eviction numbers?

The San Francisco Apartment Association says that a recent court decision impacting the rules governing eviction notification may have prompted housing providers to serve the same notice twice in a “clean-up” effort to comply with the new ruling.

In that case, handed down by the appellate court in late June, essentially told housing providers they must provide greater clarity in 3-day notices. The tenant must be able to determine the deadline for paying rent to avoid eviction and understand the consequences of failing to pay rent.

Arguably, the current 3-day notices being used by landlords who kept up to date were already compliant, but out of an abundance of caution, our industry partners added some additional verbiage to the notices to ensure compliance. This is a topic we took on here. We, for one, have admonished housing providers to review the new notice requirements. Namely, the notice must convey:

-

Start and end dates of the notice period.

-

The date the notice was served.

-

A clear notation that weekends and judicial holidays do not count.

-

If the rent is not paid by a certain date, the tenant will lose possession of the unit.

Settlements are under the radar.

Our friendly competitor, attorney Clifford Fried, told the Examiner that San Francisco’s right-to-counsel program has skewed eviction numbers because an overwhelming number of cases are settled or dismissed. We concur.

Although there is a phalanx of free tenants’ attorneys able to hold up evictions, if not prevail on technicalities, resources are becoming thin – the demand simply outpaces supply.

We created a bit of a dustup by saying that tenants’ attorneys are walking a tight rope with multiple statutes and rules that require attorneys to act in good faith and forbid them from filing frivolous motions purely designed to harass, cause delay, or needlessly ratchet up the legal costs of the opposing side. Bornstein Law and other counsel are regularly tasked with defending against these baseless claims.

![]()

In representing a client, a lawyer shall not use means that have no substantial* purpose other than to delay or prolong the proceeding or to cause needless expense.

Rule 3.2 Delay of Litigation (Rule Approved by the Supreme Court, Effective November 1, 2018)

Even though the arguments articulated by the tenants’ attorney may have no merit, our office has to respond to them, and this costs clients money. While some programs and nonprofits zealously defend against eviction actions, we are unaware of any initiatives that cover the legal expenses of landlords.

There was an exception in Alameda County, where there was some chatter about footing the bills of landlords, but this ended up being lip service, with no funds trickling down to housing providers. Instead, the county injects money into the coffers of militant tenant advocates like My Eden Voice. We do commend Supervisor Haubert for trying, but he was up against the 800-pound gorilla of tenant lobbyists.

Sympathizers of tenants told the Chronicle that there is a financial crunch for many renters, pointing to job losses, especially in some industries that employ large numbers of low-income people, including the hotel, retail, and restaurant sectors. We are humans and empathize with those going through a hardship, but professionally, we have to zealously represent our clients.

Ever since the Gold Rush, San Francisco has been a boom or bust market. We now have an AI boom that is putting upward pressure on rents. As we told Al Jazeera long ago, we should embrace a technosphere that is the envy of the world. Unfortunately, there will be people who are priced out of San Francisco's rental market, but we, too, are priced out of markets we can't afford. Take a look at what our founding attorney said when asked about these dynamics.