IN DEPTH

California rent control laws

![]()

In response to the moans against escalating rents, epic commutes and gentrification, the Tenant Protection Act of 2019 (AB-1482) was passed. Bornstein Law can help you adjust to this cumbersome law.

Are you braced for statewide rent caps and eviction controls?

In this webinar, our founding attorney breaks down AB-1482 in an easily digestible fashion and offers some strategies to future proof your rental business.

Some of our takeaways:

Kick the tires a bit

A tenant only enjoys protections of the new state law when in possession of the unit for 12 or more months. If leery owners do not want to be subjected to a new regulatory regime, there is nothing that prohibits a “trial” period.

That is, owners can rent the unit on a month-to-month basis, or enter into a 10-or 11-month rental agreement. If the tenant has not yet resided there for 12 months, the tenancy is under the radar and not subject to statewide rent control. At the expiration of the shorter-term lease, the owner can reevaluate the relationship and determine if the tenancy should be continued, but this decision is made prior to added protections being kicked in.

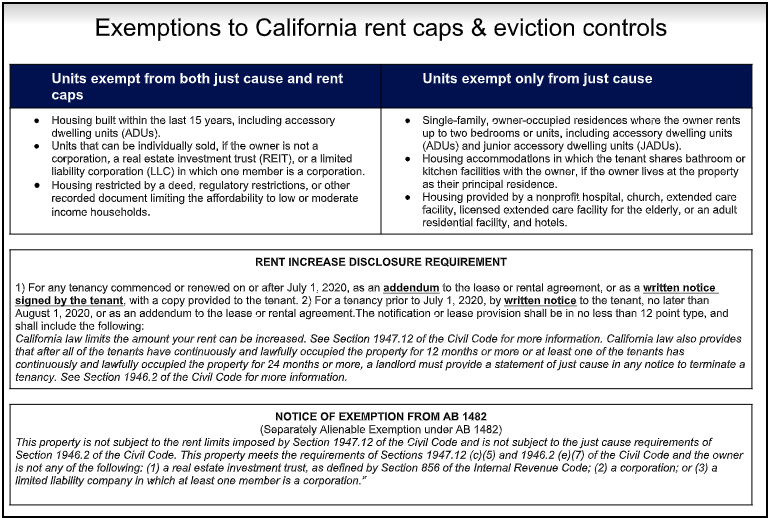

MANDATED DISCLOSURES

We have fielded many questions about when disclosure requirements are required. Fast forward to July, when you have a tenant in a pre-existing lease - owners must include an addendum with requisite disclosures. If the tenant does not sign this addendum, it can be posted on the door and mailed.

Any tenancies commenced after July 1, 2020, will need the disclosures embodied in the lease. If you have a new tenancy from now until July, we recommend you insert the disclosures, even though you are technically not obligated to do so. Do not worry - we have the disclosures prepared.

Rent Caps retroactive

Anticipating a binge in rent hikes after landlords got wind of a new law capping rent increases, lawmakers rolled back the clock.

It is a bit strange. Although AB-1482 went into effect on January 1, 2020, for the purposes of calculating the maximum rent increase, we need to look at what the rent was on March 15, 2019.

If you have raised the rent exorbitantly between March 15, 2019 and January 1, 2020, we must address the improper rent increase. If you were over-exuberant and increased the rent after March 15 of last year, you don’t necessarily have to return the money, but you have to inform the tenant of what the proper rent increase is.

There is a protocol to follow to right a wrong, so please contact our office to get back in good graces if your post-March 15, 2019 rent increase has exceeded the limits allowed by law.

We have said in many venues that an improper rent increase will tank an unlawful detainer action. Aided by no shortage of free legal representation, outgoing tenants can prevail in an eviction action by refusing to pay rent that is not legally due.

Improper rent increases are so egregious, they made our list of the top 5 reasons why landlords lose an unlawful detainer action.

Many of you in rent-controlled jurisdictions are cognizant that you can “bank” rent increases, but under AB-1482, rent increases can only be made twice in a 12-month period. If you get absentminded and want to raise the rent outside the prescribed time limits, you are out of luck. If you don’t use it, you lose it.

In a parting thought on rent increases, owners will not be able to impose a rent increase on a tenancy that would otherwise be exempt from rent caps, unless the disclosure is made that the unit is exempt from AB-1482.

What is the permissible rent increase amount, anyway?

The newly minted state law calls for annual rent caps of 5 percent plus the annual increase in the cost of living (CPI) from April 1 of the prior year to April 1 of the current year, or 10 percent, whichever amount is lower. Barring an epidemic of inflation, we would expect this to well below 10 percent in the Bay Area. Take a look at the historical CPI fluctuations.

Put a finger on when the property was built. New developments can attrition out of the exemption.

If you own or manage a newly constructed building, please don’t get a false sense of bravado. Be aware that even if your property is exempt from statewide rent caps and eviction controls today, it may attrition out of this exempt status at some point in the future - it’s a rolling target.

If the property was built within the past 15 years, you can breathe a sigh of relief, but only until the 15th anniversary of when the first certificate of occupancy was issued.

We are especially concerned for “wobblers” that are teetering on the edge of construction dates, as owners who think they are off-limits to the law wake up one day to discover they are now subject to the rules.

Single-family home exemption

Single-family homes are not enveloped by the new legislation unless owned by a corporation, real estate investment trust, or LLC in which at least one member is a corporation, because to lawmakers, this sophisticated ownership structure screams “greed-fueled speculators,” the ilk of which was seen by corporations scooping up dozens or hundreds of properties in the heyday of the foreclosure crisis. Real estate investment trusts (REITs) with an ownership stake in a single-family home do not pass the smell test and tenants in these dwellings are afforded full protection under California law, even if it is a single-family home.

If, however, your single-family home is being used as a boarding house, with multiple units being carved out for rentals, you need to exercise caution because recent case law is redefining a single-family home. Sympathetic courts have ruled that individual living quarters are considered a “dwelling unit” subject to rent control, even if is under the roof of a detached home.

Read our blog: Statewide rent control puts single-family homes on the firing squad →

Our main takeaway: If you are using your single-family home as rental units, if it is bursting at the seams with tenants, you may lose the exemption, even if it is technically a single-family home.

AB 1482 has a built-in mistrust of certain ownership structures because they scream "greed-fueled speculators." We see this as part of a broader effort to chip away at protections for single-family homes that were once sacrosanct, a topic we took on in this article

Permissible just cause reasons, in bulleted format

“AT-FAULT” JUST CAUSES

The owner must have evidence to support the basis for the eviction based on any of the following:

- Failure to pay rent;

- Breach of a material lease term, as defined by the law;

- Maintaining, committing, or permitting the maintenance or commission of a nuisance, as defined by the law;

- Committing waste, as defined by the law;

- Written lease terminated on or after January 1, 2020 and after a written request from the owner, the renter has refused to execute on a written extension or renewal of the lease based on similar lease terms;

- Criminal activity by the renter on the property, including any common areas, or any criminal activity or criminal threat on or off the property that is directed at any owner or agent of the owner;

- Assigning or subletting in the premises in violation of the lease;

- Refusing the owner access to the unit as authorized under the law;

- Using the premises for unlawful purposes, as defined by the law;

- An employee (e.g. resident manager), agent or licensee’s failure to vacate after their termination;

- Failure to deliver possession of the unit following written notice to the owner of the renter’s intention to terminate the lease, which the owner has accepted in writing.

NO-FAULT” JUST CAUSES

- Intent by the owner or owner-relative to occupy the unit. This includes the owner’s spouse, domestic partner, children, grandchildren, parents, or grandparents only. For leases entered into on or after July 1 2020, the owner would only be permitted to occupy the unit, if the renter agrees in writing to the lease termination or the lease includes a provision providing for lease termination based on owner or owner-relative occupancy;

- Withdrawal of the rental property from the rental market;

- Intent to demolish or substantially remodel the unit;

- Owner is complying with a local ordinance, court order, or other government entity resulting in the need to vacate the property.

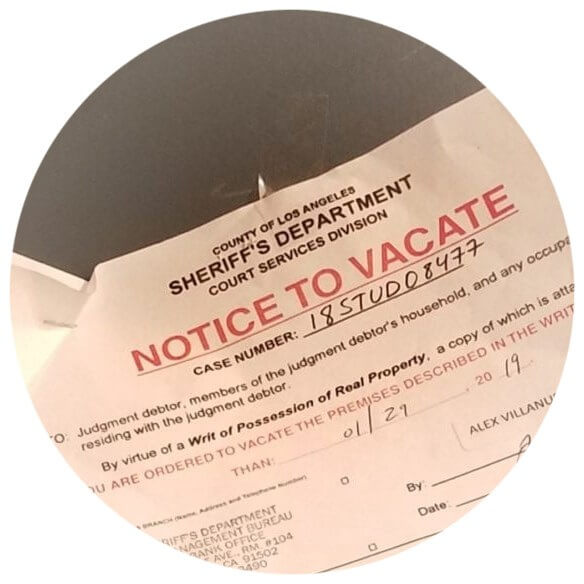

At-fault just cause

![]()

AB-1482 delineates certain at-fault just causes that are pretty obvious, such as non-payment of rent and other breaches of the lease, so long as the tenant has the opportunity to cure the transgression. Yet state law has an at-fault just cause that jumps off the page.

When tenants do an about face

Interestingly, while in rent-controlled jurisdictions such as San Francisco, tenants cannot be penalized for changing their mind after they gave notice to the landlord to vacate, state law gives landlords the ability to evict with just cause if the tenant fails to renew the lease.

So, if a tenant who has lived in a unit for over 12 months gives notice to vacate and later decides to recant and stay put, AB-1482 says word is bond and the owner can nonetheless transition the tenant out of the unit. When a tenant signals an intention to leave, owners or their agents should acknowledge the notification, document it, and arrange for a pre-move out inspection.

If the tenant changes his or her mind, it is too late - the owner can proceed with an eviction on the theory the tenant has failed to vacate after notice of termination.

No-fault just cause

![]()

In a limited set of circumstances, tenants can be transitioned out of the rental unit through no fault of their own.

• Owner/relatie move-in (OMI/RMI) (disclosures required)

• Ellis Act

• Government requires property to be vacant

• Demolition/substantial rehabilitation

A few remarks when it comes to no-fault evictions

New state law spells out certain conditions when a tenant can be transitioned out of the unit through no fault of their own, one of them being substantial rehabilitation. The operative term is substantial. We are not talking about a paint job, or sanding and refinishing a hardwood floor in the living room. We are referring to major electrical upgrades, new HVAC systems, and the like.

If you are contemplating a big project like restoring a building that has been burned down to the ground, please pull the permits and contact our offices so that we can effectuate the vacancies, with proper notice.

The relocation payment scheme with statewide law is relatively easy. It requires that owners provide a one-month rent waiver or pay a tenant one month’s rent within 15 days of service of the notice.

This farewell gesture is not generous enough for those of you in certain jurisdictions with more stringent rules that can force owners to fork over thousands of dollars in relocation payments, especially when the displaced tenant is part of a protected class like long-term tenants, elderly tenants, residents with disabilities, educators, households with children, and so forth.

We do not want to burst your bubble, but if your property is situated in a locale with these more protective ordinances, you are bound by them.

Failure to provide disclosure notices may tank an OMI/RMI.

With vacancy rates so low, our office has effectuated many Owner Move-In or Relative Move-In evictions in order for new homeowners or their close relatives to move into a property. As long as there is no history of acrimony with the tenants, this can be done fairly easily.

However, there will be an issue if the tenant is not apprised in the rental agreement that a "just cause" to terminate a tenancy under Civil Code 1946.2 includes termination "if the owner, or their spouse, domestic partner, children, grandchildren, parents, or grandparents, unilaterally decides to occupy the residential real estate property."

Let’s take a catastrophic what-if. The above disclosure is not included in the lease and the buyers of a tenant-occupied property, having stretched for a huge mortgage payment, purchase the property to move in, only to find out that they cannot recover possession of the unit because the tenants have not been alerted that an OM/RMI is a permissible reason to evict under the state rules.

EXEMPTIONS

![]()

Owners can be exempt from rent cap rules or just cause eviction rules, or both. Download this cheat sheet to see if you are subject to AB-1482.

Double the trouble?

![]()

Duplexes are exempt to rent caps when the owner lives in one unit since the beginning of the tenancy. One of the riddles to solve is whether the owner’s residency predates the tenant's occupancy.

Has tenant pre-existed owner?

If so, the tenant is subject to rent caps. When the tenant leaves the unit, the owner can re-rent the dwelling to a new tenant without being subjected to rent limits.

If, however, the owner lives in a unit before a tenancy was commenced, they are the king of their castle and state law will not apply.

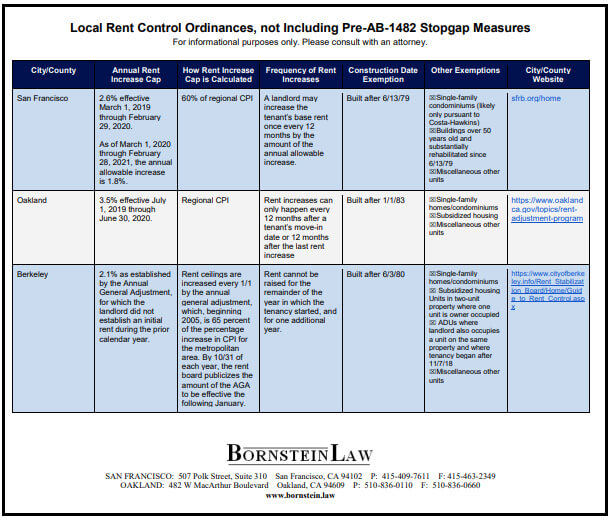

The first and most compelling exemption to state law is when owners are hamstrung by local ordinances that are more protective than AB-1482.

The first equation to solve is whether a local ordinance affords greater protections to tenants than those given under state law. We've taken a trip around the Bay Area to summarize some of the local rules, to determine what trumps AB-1482 in terms of lower rent increases and added eviction safeguards.

![]()

Tenant buyouts make more sense in a new era

Vacancies have always carried a premium. When properly staged, a vacant property will typically sell for more money than if tenant occupied because the new owners have a blank canvas. Since it’s more difficult to effectuate a vacancy now with “just cause” eviction protections statewide, tenant buyouts become even more appealing.

In these types of contracts, a tenant agrees to voluntarily leave the unit in exchange for a rent waiver, compensation, or both.

Our office routinely crafts buyout agreements and we like them because it removes any residual claims that may arise from the tenancy. More than “cash for keys,” a tenant surrender of possession agreement gives landlords peace of mind knowing they cannot get sued down the road. While the owner will have to lay out more money at first, the upside potential of a vacant property and the cauterization of risk may be well worth the outlay of funds.

We understand this can be tricky, but you can contact us for informed guidance.

As the Bay Area's foremost practitioners in managing landlord-tenant relationships, Bornstein Law can explain how AB-1482 affects your business, reconcile local ordinances with state statutes, and can suggest strategies for you to survive and thrive in a challenging regulatory regime.