New Year resolution: I will familiarize myself with security deposit law and have a greater awareness of my security deposit accounting.

![]()

Everyone knows how to demand a security deposit before handing the keys to a new tenant, but we are amazed that so many housing providers do not know what to do with the security deposit once the tenancy is over. We estimate that up to 80% of landlords fall short in some respect.

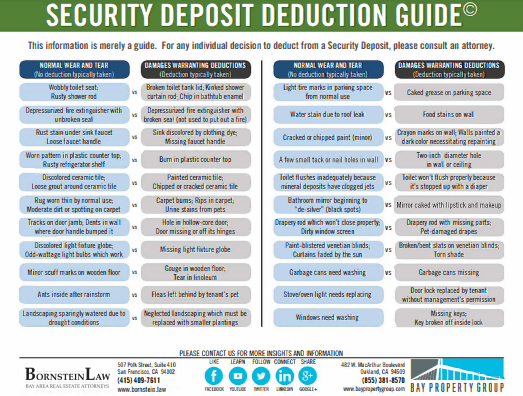

Are you conducting thorough and transparent initial inspections and pre-move-out inspections? Bornstein Law has prepared a helpful one-page guide to distinguish between damage and “normal wear and tear.”

As a refresher, landlords have 21 days to return the security deposit, either in full or with itemized deductions for damages beyond normal wear and tear, unpaid rent that it is not COVID-related (consult our office first), necessary cleaning to restore the unit to its initial condition. If these deductions exceed $125, housing providers must produce detailed itemization with receipts or estimates. If the work is not completed within 21 days, a good faith estimate can be sent, followed by the actual receipts within 14 days of the work being completed. These time frames are not open for negotiation.

Given the stress of wondering if and when the tenant will get their security deposit back, it’s no surprise that they often sue their landlord over security deposit disputes, but what some of you may not know is that the damages can be multiples of the security deposit that was improperly withheld.

It used to be that a disgruntled tenant would take their former landlord to small claims court, filing a lawsuit for, say, their $2,000 security deposit, and if the landlord loses in court, they are on the hook for $2,000. Today, housing providers who are found to horde the security deposit in bad faith and/or create emotional distress can be obligated to pay thousands of more dollars. Like suing landlords for turning down Section 8 rental applicants, some opportunistic attorneys are all too willing to litigate cases when the landlord did not follow through with their responsibilities under the law.

Fortunately, the law is plain for housing providers to see and so there should be a concerted effort for everyone to familiarize themselves with the rules or get a refresher.

Enter AB 12, a new law that limits security deposits to one month’s rent.

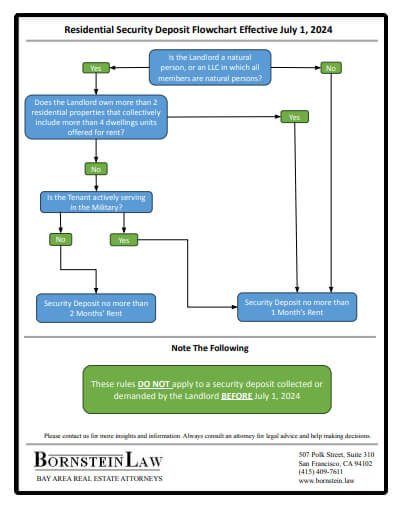

Effective July 1, 2024, housing providers can only demand a security deposit up to the equivalent of one month's rent for a residential rental. This is a reduction from the previous limits, which allowed up to two months' rent for an unfurnished unit and three months' rent for a furnished unit.

Small landlords are exempt and can collect up to two month’s rent, so long as:

They own no more than two residential properties that collectively include no more than four units offered for rent.

AND

Ownership is held by a natural person, an LLC in which all members are natural persons, or in a family trust.

For the visual types, we’ve put together a one-page infographic of this process.

Housing providers can remove the insecurity surrounding security deposits by taking security deposits seriously and not just some inconvenient chore to get around to later on. Of course, Bornstein Law can assist landlords and their agents should any questions arise.